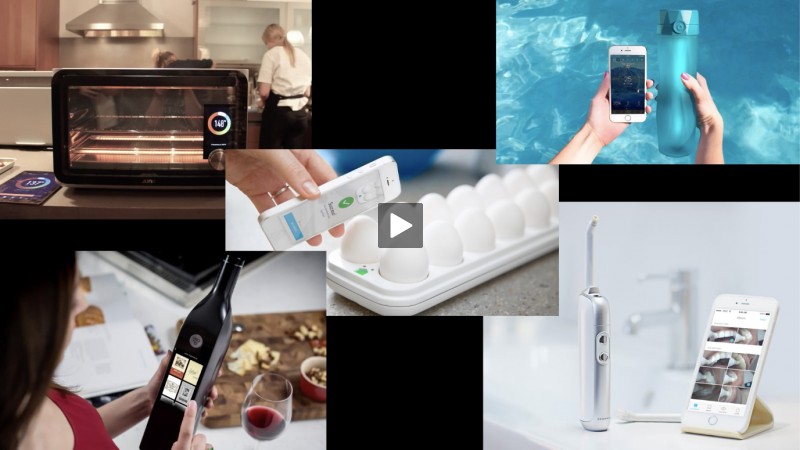

Your Smart Robot Vacuum Could Be Hacked!

Smart devices throughout your home, if not secured properly, are at major risk of getting hacked. Here’s the lowdown...

Something Smells Phishy!

Scammers are getting smarter by the day, and so are their phishing scams! Here's the latest...

Do You Care About Your Online Privacy?

The most damaging privacy invasions take place online, so you better up your game. Educate yourself with the tips in this video.

How Are You Impacted by Commercial Surveillance?

Do you know? Do you even know what it entails...? Companies are collecting, analyzing and profiting from selling information about people.

Have a kid? Go to TikTok

With social media like TikTok and its influencers, the world of "easy to recognize" ads is gone. Here’s a video to help you understand how your kids are manipulated online...

Getting a Lot of Personalized Ads?

Your behavior online determines the type of ads you get, a lot of the time. See what's happening and control the ads you see.

Worried About Your Kids Being Manipulated Online?

If your kids spend time online, they're likely encountering "social media influencers" who may try to manipulate their opinions or decision-making.

Video: AI - From Fun to Violations

AI is everywhere nowadays. How is that impacting your life? Learn more about AI and how to keep you safe with this video.