What Is Fintech? What Should You Know About It?

- Details

- Written by Remar Sutton

- Category: Articles

Ever used Venmo, Mint, Robinhood, or GoFundMe? Those services were enabled by financial technology, also known as fintech. Fintech is the use of technology to automate and provide access to financial services online. It covers a broad range of services including mobile, cloud-based, and computer apps.

Fintech services may become very useful for you as long as you make sure they fit your needs.

So, why are fintechs important to know about? It pays to know more about how fintech services work because you are probably already using many of these services.

Here are some of the many types of services available:

Digital payments allow users to easily transfer money to a business or person (e.g., Venmo, PayPal, Zelle, ApplePay, and GooglePay).

Mobile banking allows users to access your financial accounts without having to go into a branch; it also includes online only banks.

Smart contracts use software to automatically execute contracts between buyers and sellers

Crowdfunding platforms raises money for a cause, person, or business from many people – (think GoFundMe, Kickstarter, and Indiegogo).

Stock tracking apps allow users to invest with low or no commission fees (e.g., Robinhood and Acorns).

Robo-advisors use algorithms to provide recommendations and portfolio management at a lower cost (e.g., Betterment and Ellevest).

Cryptocurrencies are forms of digital cash that can be used to buy goods or to invest in – the best known example is Bitcoin, but there are many others.

Blockchain is a distributed ledger technology that maintains records or a network of computers not just one (e.g., Ethereum).

Digital insurance companies use technology to simplify and streamline insurance buying (think Oscar Health (healthcare), Root Insurance (auto), and PolicyGenius (various types)).

Services focused on unbanked or underbanked individuals to help disadvantaged or low-income individuals.

Carefully Research

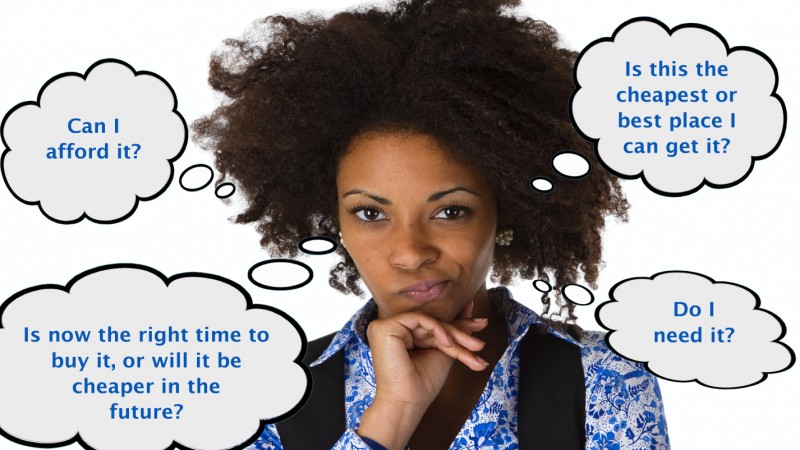

While these services can provide convenience, you should carefully research each before you choose the ones that meet your needs.

Here are some things to consider:

Determine how much of your personal and financial information you are willing to share, and how much the fintech needs to operate.

Read more than the description in the app store: visit the website, check the reviews, particularly industry reviews (this will help you form a well-rounded opinion about the app, it’s services, and if it is right for you).

How will they protect your information? Do they use encryption? Is all of your information encrypted? Note that it only takes one security issue for your data to be exposed.

What does it cost? What are the fees? Who do they partner with? Are they supported by advertising?

How will your information and data be used? Read the privacy policy and user agreement carefully - if you can't find the privacy policy, that’s a great reason not to use the app.

Only download your apps from a known source - this helps reduce the chance of the app you download containing malware.

Stay Up to Date

In addition to carefully choosing your services, make sure your devices and security software are up to date.

Use strong passwords

A password manager can help you create strong passwords - then you only need to remember the one password for the manager program.Secure your login information

Don't let your device or browser save your login information.Log out!

Always log out of your accounts and apps.-

Keep your devices up to date

Installing app and operating system updates promptly.

Fintech services may become very useful for you as long as you make sure they fit your needs.