You need to decide if you want to get overdraft protection when you get your checking account.

Here's what "overdraft protection" really is:

- It's a loan.

- You pay interest on the loans.

- You normally pay a yearly fee to get real overdraft protection.

Overdraft protection works like this: If you try to spend more money than you have in your checking account, the bank will automatically loan you money to cover the overdraft rather than bounce your check or charge you a big fee.

- Overdraft protection is a way to protect you from your own mistakes.

- It's a loan. But it can be better and cheaper than bouncing a check.

So overdraft protection can be good.

Because bounced checks can ruin your credit just as you start building credit, you should do everything you can to never bounce a check.

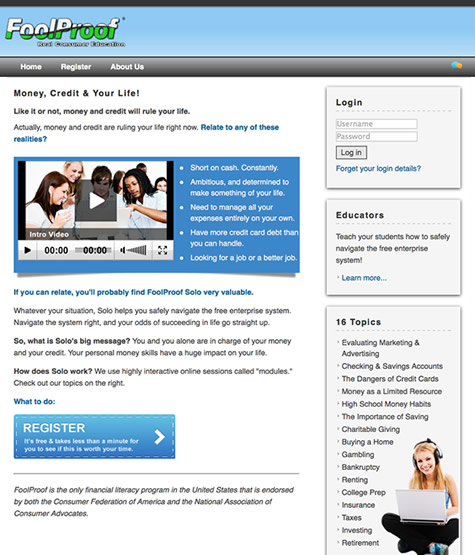

So, real overdraft protection can make sense, unless you are absolutely sure you are going to keep at least $100 in your account at all times (the FoolProof recommendation.)

But here's the rub: Some financial institutions offer a very bad form of overdraft protection, sometimes called "bounced check" protection.

Note: Many financial institutions also offer a legitimate "free" overdraft protection plan, in which if you overdraw your checking they will transfer the funds (usually $100 at a time) from your savings account and let you know it happened.