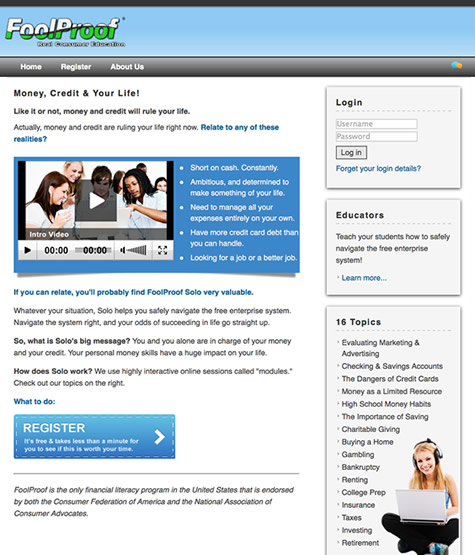

How To Mess Up A Checking Account

That's a lotta ways to mess up!

Well, guess what: we haven't told you half of the ways your checking account can be messed up.

So far, we've just talked about the stupid things you can do to mess your account up.

Look at the ways many financial institutions mess up your account...

1) Many financial institutions don't make it easy for you to know what they charge.

Many consumer groups and consumer writers think many financial institutions make it nearly impossible for you to figure out bank charges. The institutions counter that all of their disclosures are easy to find.

2) Many financial institutions change their fees without clearly telling you about the change.

They set the fees. And they set the penalties.

Today, something may be free. Tomorrow, you may be charged for it.

You don't see the change, and mess up your account!

Most banks, for instance, deduct big checks from your account before they deduct small checks.

Sounds innocent enough, doesn't it?

Well, check this out!

Why would financial institutions do this?

- Banks say they do this as a favor to you...

- Consumer groups say it's no favor...

But, did you notice? This all happened because you forgot to put money in the bank!